RENT OR OWN, HERE’S WHAT BABY BOOMERS WANT NEXT

A ‘new normal’ affordability and closer connections are what retiring Baby Boomers want from their moves in the next few years.

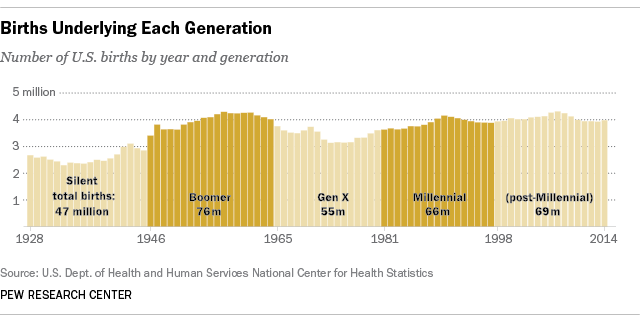

The Baby Boom–the original pig-in-a-python generational cohort–is frequently associated with the birth years 1946 to 1964. As Pew Research shows us here, those years account for about 76 million births in the United States, and now, estimates are that that number has shrunk to just under 75 million.

This shows that the Baby Boom–now ages 69 down to 51–is almost fully expressed in the 55+ housing market, which, in turn, exposes the flaws in characterizing the market as 55+.

As we’ve seen in earlier work, the trajectory among the 75 million Baby Boomers is toward working longer, and the economics of uncertainty, costs of healthcare, and longevity trends are likely to add rocket fuel to that trajectory.

We’ve also noted that homeownership rates for the age ranges that encompass Baby Boom generation households are high. Very high, ranging from 70% among the trailing edge of the cohort, and close to 80% for the leading edge 69-year-olds.

This is all by way of saying that newish data from Freddie Mac, entitled “Over Five Million Baby Boomers Expect to Rent Next Home by 2020” is helpful, but not for reasons it necessarily intended.

Its headline infers that a flood of Baby Boomer movers will pick renting rather than owning as they move into their retirement house. The data doesn’t back that up. Essentially, the data suggests that 7% of Baby Boom age respondents (projectable to 5 million people), both homeowners and renters plan to move into a rental in the next four years. Mostly, renters plan to rent; and a small share of homeowners plan to rent at some point in the future as well. That’s not particularly telling.

The really important insights in the Freddie data focus on motivations and preferences, which are meaningful to both for-sale developers as well as for-rend community builders.

Here are the three motivational areas that jump out in the data:

Their top attractions are affordability, amenities

Among the top “very important” factors influencing their next move, respondents picked affordability (60 percent), amenities needed for retirement (47 percent), living in a community where they are no longer responsible for caring for the property (44 percent) and being in a walkable community (43 percent).

They don’t want to move far

Among those who plan to move again, 55+ renters would like to relocate to a different neighborhood in the same city (31 percent) or a different property in the same neighborhood (23 percent) compared to those who would like to move to a different city in the same state (18 percent) or move to a different state (24 percent).

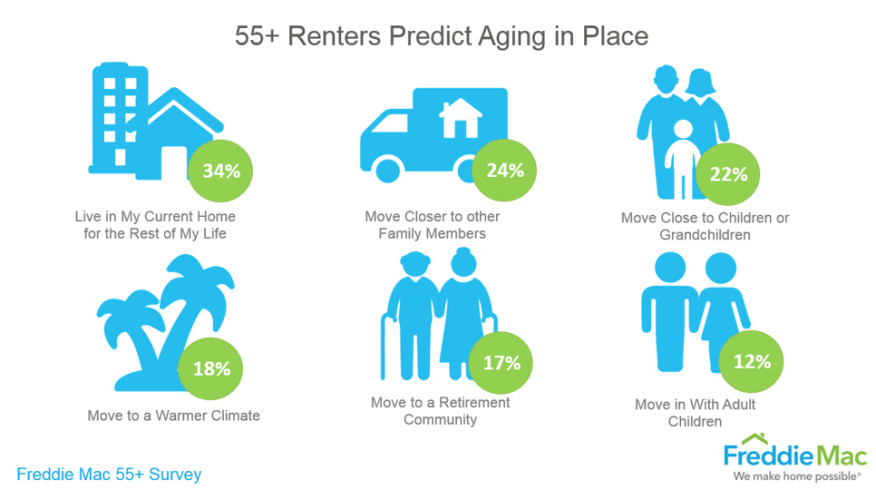

They want family near (or in) their next home

When asked to predict their retirement housing situation nearly six out of ten 55+ renters prefer to either move closer to their families or in with them. Hispanic single-family renters (44 percent) were most likely to predict they will move closer to family, while multifamily Asian-American renters (40 percent) were most likely to predict they will move in with their children.

Here are the take-aways we can glean from this and other data on retiring Boomers.

- In 10 years or less, 55+ will be a meaningless segment as regards housing market positioning, as it will refer less and less to life-stage change, nearing retirement, etc.

- Affordability is and will be increasingly a trump-card factor in housing choices among those nearing or reaching retirement ages

- Proximity and connectedness will outweigh autonomy and sunny climes as must-haves for movers.

For related insight into what Baby Boomer home buyers and remodelers prefer in their homes, drawn from extensive research by AARP, have a look at our Data Studio’s reports here and here.